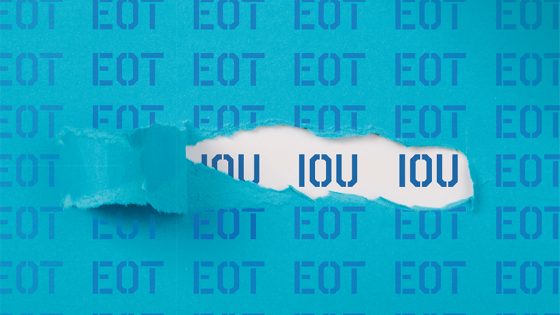

With three large employee-owned companies entering administration in the past year, CN asks if the model has inherent weaknesses

Buckingham Group, Readie Construction and Michael J Lonsdale are among the biggest contractors to have gone under in the past 12 months. Factors identified by directors of these firms include inflation, Covid, the war in Ukraine, subcontractor failures and loss-making contracts. Undoubtedly those issues have hit many in the sector hard. But was there another issue that put extra pressure on the cashflow of these companies that has been little discussed to date?

A Construction News analysis of Companies House filings shows that between them, the three paid a total of £33.95m to employee ownership trusts (EOTs) since 2020. The sum far outstripped their aggregate bottom lines – which amounted to a pre-tax loss of £4.7m.

The trio is among dozens of contractors to have turned to employee ownership in the past four years. Given the issues they faced, CN examines whether the model should still be seen as attractive, and assesses the rarely mentioned risks.

Legacy

A CN analysis in 2022 found that contractors with a combined turnover of £1.65bn had been sold to EOTs in the prior two years. Since then, EOT-owned companies with a combined turnover of £1.3bn have ceased trading.

In 2014 the then coalition government started encouraging employee ownership, changing tax rules to incentivise such sales. As a result of the reforms, shareholders pay no capital gains tax on the money received from a sale, and the trust that hold shares on behalf of employees can pay each worker an income-tax-free bonus of up to £3,600 each from a share of its profit.

“If it’s done properly, it has got merit. It will continue to be used in construction because it is so hard to sell a general contracting business”

Brendan Sharkey, MHA

The trust normally pays an initial sum to the former owners for their share, then pays off the remainder of the valuation in subsequent years. After this, employees anticipate a further share of the proceeds if the company is sold on again. The process has become popular among contractor bosses looking to retire but keep their business names alive and under the control of people they know.

Accounts for the parent company of Michael J Lonsdale, which was sold to an EOT in February 2020, show that the mechanical and engineering (M&E) specialist made an initial contribution of £11.4m to its EOT in the year to 30 September 2020. Pre-tax profit in the same year was £2.8m. The following year it made a £1m contribution to the EOT, while its profit fell to £2.1m, and the year after that it made a £1.2m contribution as profit fell to £1.9m.

According to a report by administrators at Begbies Traynor, Michael J Lonsdale’s former owners Gary Herbert and Michael Hoodless wanted to establish a legacy by selling the business to employees. As they and other board members were approaching retirement, they hoped to establish a sense of ownership among the workforce and their plan was to initiate a four-year transition to a new leadership team. They hired a consultant to help identify future leaders within the company through measures including interviews and psychometric testing, the report says.

They set up a 10-year payment schedule, after which the employees would own the business. However, Lonsdale went into administration in October 2023, citing Covid, Brexit, the effects of the war in Ukraine and a decline in its credit rating.

Exciting future

The administrators at Grant Thornton did not mention Buckingham Group’s transition to an EOT in their only published report on the contractor so far. Directors of the company blamed the failure on losses incurred on three stadium contracts and an earthworks job in Coventry when it ceased trading.

The £665m-turnover contractor was sold to an EOT in September 2021. Its accounts for the year to 31 December 2021, the last it would file before going into administration in September 2023, recorded a £10.7m pre-tax loss. The accounts highlighted issues including a £14m hit on a stadium job following the collapse of a subcontractor.

That year, Buckingham paid £14.15m to the EOT as a first payment for the shares. The accounts said the payment came from “a prudent level of retained profits” and the rest would be paid “in an affordable manner, from future ongoing trading profits”.

They added: “Both the new management team and the vendors are excited about the future under employee ownership and remain significantly motivated, financially and emotionally, by the long-term success of the business.

“As well as providing employees continuity and a stake in the business, the EOT also provides the opportunity to share in profits and to enjoy added tax benefits from the long-established staff profit-share scheme.” However, no more profits were made by the contractor.

“The company pays the EOT out of its future profits and it has to be enough to pay off the former owners, but not so much that it hobbles the company that’s left”

Chris Blundell, MHA

Grant Thornton says it is unable to comment further on the administration.

Readie Construction went under in February, citing “inflationary cost pressures, numerous subcontractor failures, [and] chronic tightening in the performance bond and trade credit insurance markets”.

The contractor was sold to an EOT in 2021. It paid £2.2m to the trust in the year to 31 March 2021, as a part payment for shares. In the same year it made a pre-tax loss of £512,000. It also paid a further £770,000 in legal and advisory costs for the sale. The following year it posted a £1.9m profit and distributed £4m to the trust. It was loss-making again in 2023 and made no distribution.

Risky

“I think EOTs are inherently risky if the company does not pursue a conservative strategy around EOT disbursements in the way they’ve historically had around dividends,” says Chris Davies, managing director of DRS Bond Management. “You can only turn the tap on so many times before the water runs out.”

While not commenting on the specifics of the firms that went under, he says that contractors need to be able to insulate themselves from periods where less work is available and that paying out to an EOT can harm those efforts. “The basic fundamentals prevail. ‘Cash is king, preserve cash. If in doubt, don’t pay out’, would be my advice when it comes to an EOT,” Davies says. He adds that the situation is riskier if company founders remain heavily involved in the business and can influence the level of contributions made to a trust as well as continuing to lead the contractor.

Chris Blundell, partner at chartered accountants MHA, says: “The company pays the EOT out of its future profits and it has to be set at the right level so it’s enough to pay off the former owners, but not so much that it hobbles the company that’s left. If it’s run in such a way that the [ex-]owners, despite the fact that they’ve sold the company, are still involved on the board and still decide what should happen, that can be a problem.”

HMRC released proposals last year on reforming EOT rules to prevent former company owners retaining majority control of an employee ownership trust. A consultation on the proposals closed in September 2023 but no changes have yet been made.

| Insolvent EOT contractors | |||

| Last turnover (£m) | Aggregate pre-tax profit/loss since sale (£m) | Contributions to EOT since sale (£m) | |

| Buckingham Group | 665 | -10.7 | 14.15 |

| Readie Construction | 421 | -0.1 | 6.2 |

| Michael J Lonsdale | 204 | 6.1 | 13.6 |

| TOTAL | 1,290 | -4.7 | 33.95 |

Slim margins

Buckingham, Readie and Lonsdale represent just three of dozens of companies that have become EOTs in recent years, with the vast majority continuing to trade successfully.

Their insolvencies also came as business failures in the sector have reached levels not seen since 2008/09, with those owned under various models going to the wall. Terry Moore, real estate tax partner at accountancy firm BDO, says: “[They] are often slim-margin businesses and therefore there would always be an element of risk with a construction company being sold on [as to] whether it will survive [in the] long term, but to my mind it’s often the economic factors that are the likely downfall.

“There’s a whole lot of things that can go wrong: cashflow issues, subcontractor failures, banks that have been very nervous about the construction industry. There’s a lot of reasons why companies in the construction sector go into administration and I don’t think it’s usually linked to them having been sold to an EOT.”

All of the commentators CN spoke to for this feature stressed that they could not comment on the specific circumstances of the three large contractors analysed above. All also agree that EOTs are likely to remain popular in the sector. “I don’t think it’s very different to any [other] sort of buyout scenario, or any other sector,” says Alan Kelly, partner at insolvency firm FRP. “I know some EOTs are very successful. It comes down ultimately to the capability of the management team that is left.”

With mergers and acquisitions in the sector having dwindled in popularity, private equity looking for huge returns, and a decline in the use of MBOs, there are not many options for business owners looking to sell up with the hope that their company will continue trading.

“If it’s done properly, it has got merit,” says MHA head of construction and real estate Brendan Sharkey. “I think it will continue to be used in construction because it is so hard to sell a general contracting business.”

Moore notes that MBOs have declined in popularity because they often involve taking on debt that appears on a balance sheet. “Unless structured very carefully, MBOs are difficult to achieve within this kind of sphere, whereas an EOT is more achievable because you don’t have to laden the business with debt,” he says.

“Employees can see that once the founders have been paid off, the value of the company is for the benefit of the beneficiaries”

Matthew Emms, BDO

Matthew Emms, tax partner at BDO, says there is still much to commend about the EOT route. “One of the construction companies I worked with said that selling his business to an employee ownership trust was a game changer for its ability to attract and retain employees.

“Employees can see that once the founders have been paid off, the value of the company is for the benefit of the beneficiaries. We are of the view that EOT-owned companies are good at retaining, incentivising and rewarding employees. They can help companies become more productive and profitable and stimulate the economy; these are the principal reasons why the government established the EOT legislation in the first place.”

Moore adds: “EOTs are a great way for someone to cash in their capital value in a way that protects the business, provided the management team coming up behind are really strong.

“But even if you have got a strong management team, you can never say the business will survive long term because construction is just a sector where there are risks.”

| Largest EOTs by turnover since January 2020 | ||

| Turnover at time of sale (£m) | Number of employees at time of sale | |

| Buckingham Group | 585 | 623 |

| Briggs & Forrester | 223 | 935 |

| Readie | 179 | 170 |

| Michael J Lonsdale | 140 | 250 |

| Ground Construction | 96 | 75 |

| Kilnbridge | 91 | 352 |

| McGee | 76 | 362 |

| Neilcott Construction | 75 | 160 |

| NGB Construction | 57 | 208 |

| Curtins | 28 | 400 |

| Triton Construction | 28 | 61 |

| Fitzgerald Contractors | 17 | 120 |

| Elland Steel | 15 | 94 |

| TOTAL | 1,470 | 3,560 |